Why China Is Quietly Winning At EV Battery Recycling

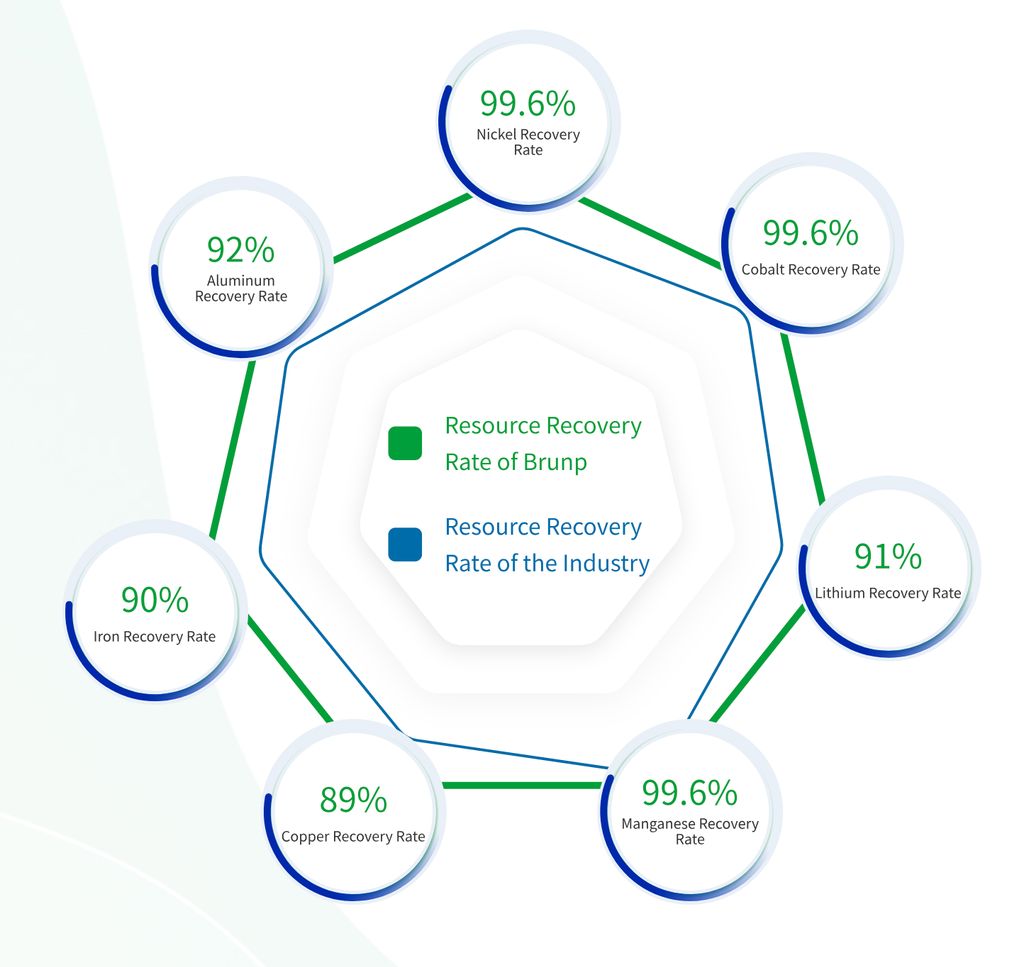

- Companies in China claim they can now recover 99.6% of the nickel, manganese, and cobalt from an end-of-life EV battery.

- They don’t make it clear if these are pilot program numbers or if that’s what they’re achieving at scale.

- China is the world’s leading EV battery recycling power and it’s unlikely the West will catch up anytime soon.

The world needs to get electric vehicle battery recycling right. Those cells are complicated to recycle, and the goal is not to simply dispose of them once they are spent. Ideally, we want to recover as much as possible of the materials that go into their construction, so that they can be reused.

This has so far proved a challenge around the world, but now certain companies from China say they are able to retrieve up to 99.6% of the nickel, manganese, and cobalt that goes into EV batteries. If verified, that’s a remarkable achievement, and it surpasses the level the European Union plans to reach after the end of the decade and at much lower recycling volumes. (Nickel-manganese-cobalt, or NMC, is the most common type of lithium-ion battery among today’s long-range EVs.) The report was first highlighted by Car News China.

Photo by: CATL

China is a global leader in both EV battery production and recycling. It recently implemented new stricter EV battery recycling standards and is also pushing for global adoption of these standards. When China’s Ministry of Industry and Information Technology (MIIT) first proposed these standards in 2019, it specified that 85% of the lithium that goes into these batteries should be recovered, but this was increased to 90% in 2024. Other reports indicate researchers in China are making big breakthroughs in this arena.

China’s biggest EV battery recycler is Guangdong Brunp Recycling Technology, a subsidiary of battery manufacturing giant CATL. The company says it has a fully automated recycling process that can handle 120,000 tons of waste batteries and is working to increase that capacity to 1 million tons. It says it has over 200 recycling locations in operation today and that it handles just over 50% of China’s EV battery recycling needs.

It’s worth noting that it’s not clear if the 99.6% recovery rate has been achieved at scale or just in lab testing. It’s probably the latter, and if the recovery process is energy-intensive, it will therefore create a lot of pollution. Some Chinese recyclers use acid leaching (hydrometallurgy) to recover lithium and other elements at a very high purity level, and while this reduces energy needs, it also requires treatment of the wastewater, which is a step that some companies might be willing to overlook to cut costs.

Targets for rare earths, copper and aluminum have also since been introduced. They need to have a recovery rate of 98%, which is the same as for nickel, cobalt and manganese. Some companies are already exceeding these recovery percentage guidelines and are able to retrieve over 99% of these key materials.

The figure is specifically 99.6% for nickel, manganese and cobalt and slightly lower, at 98%, for lithium. The standards don’t just apply to electric passenger vehicle batteries, but also to batteries used in energy storage, marine applications and other uses.

These recycled materials will naturally be reused in new battery packs, automatically lowering the demand for virgin materials. One of the most controversial areas surrounding electric vehicles today is the environmental impact of digging up lithium, rare earths and other elements out of the ground. The labor behind mining for these elements is not always ethical, and it affects natural habitats, so recovering these materials instead of getting new ones will become increasingly important in the future as more vehicles become electric.

The European Union wants to pass a law where any battery with a capacity higher than 2 kilowatt-hours will have to contain certain percentages of recovered materials by 2031—16% for cobalt and 6% for lithium and nickel. The aim is to reduce waste, promote a circular economy and reduce environmental impact. By 2031, the EU also wants to increase recovery rates for cobalt, copper, lead and nickel to 95% and 80% for lithium. All numbers that are lower than what China says it’s capable of retrieving today.

China will likely remain the leader in both production and recycling of EV batteries, and as it amasses more of these elements, most of which are not mined locally, its need for freshly mined virgin materials will go down. This will allow China to essentially close the loop and become virtually independent and self-sufficient, relying solely on high-yield recycling of millions of existing EV batteries rather than bringing in raw materials from places like Africa or South America.

In the U.S., Redwood Materials is one of the biggest battery recyclers. It says it too has technology to allow it to recover up to 95% of the nickel, cobalt, lithium and copper from an end-of-life EV battery pack, but it has yet to do it at scale. The company wants to use these recovered materials to create new battery packs and is targeting a production capacity of 500 GWh by the end of the decade.

Reuters noted back in 2023 that the U.S. Inflation Reduction Act included “a clause that automatically qualifies EV battery materials recycled in the U.S. as American-made for subsidies, regardless of their origin.” The goal was to incentivize EV battery recycling in the U.S., in an attempt to break China’s almost total global monopoly in the field.

With the Trump administration now stripping back incentives for EVs, batteries and their supporting industries, it doesn’t look like China’s battery recycling leadership will be challenged anytime soon. As time progresses and more vehicles on the road become electric, and as the ones that are on the road today begin to age, the need for battery recycling will increase considerably.

Will the West’s spent EV packs end up being shipped to China to be recycled?

Source link