Car Companies Know Subscription Fatigue Is Real. Here’s How They Think They Can Outlast It

- Fewer drivers than ever want to pay for in-car subscriptions.

- Automakers don’t believe it and are looking to find out what consumers will really pay for.

- Here’s why automakers are doubling down despite consumers growing tired of more monthly payments.

You know what people love? Paying for stuff to keep using it over time.

Just kidding. Literally nobody—not a single soul—is asking for yet another monthly charge on their credit card. As if the streaming services, fitness apps, and that little sous vide thing in your kitchen weren’t enough, automakers now want in, too.

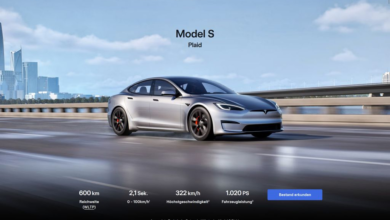

Car brands are obsessed with turning their vehicles into rolling app stores. Need a heated steering wheel? No problem, $9.99 per month. Supervised Full Self-Driving? That’ll be $99. And the list goes on.

It’s not just some passing trend. Executives at GM, Ford, Kia, Toyota and just about every brand under the sun have seen how the subscription model works. They’ve seen what Adobe did with Photoshop and they probably have their own personal subscriptions to Netflix and Spotify. They want that. And it’s all because it proves company value to shareholders with additional revenue streams—most importantly, the one that does it using a single flashy term: Monthly Recurring Revenue.

There’s just one small problem: drivers don’t want it.

S&P Global Mobility’s 2025 Connected Car Study says that only 68% of drivers would even consider paying for connected car services. I know that might seem like a lot, but considering that number is down from 86% in 2024, the number of consumers actually willing to toss some cash into the proverbial subscription fire is decreasing at a pretty rapid rate.

Here’s a snippet from the survey that outlines what’s going on in the minds of these folks:

The cost of hardware and software for connected car features can be substantial, making it difficult to integrate these features into mass-market and budget-friendly vehicles. Subscription-based services (navigation, Wi-Fi, etc.) are increasingly being met with resistance from price-sensitive consumers who may not see the value in paying recurring fees for features they do not frequently use.

Users are frustrated when hardware (e.g., cameras, sensors) is present but features are paywalled. Consumers are also pushing back against “feature fragmentation” where basic functions are split into multiple paid tiers.

It’s not just about how many people want to pay, either. Consumers are really pinching pennies and want to spend less on in-car subscriptions than they do watching Hulu.

In fact, many of the survey respondents who said that they don’t use connected car services told S&P that cost was the primary factor behind them not utilizing these connected services. And those who didn’t care about cost as much told S&P that their smartphones already do what automakers want to charge them for.

Could this be a reason that automakers are shutting out device mirroring like Apple CarPlay and Android Auto?

Granted, there are some things that a cell phone just can’t provide. Think: Tesla’s $1,200-per-year Full Self-Driving or Ford’s $495 BlueCruise subscription. But let’s be real—if your phone could throw up real-time traffic maps, integrate with your car’s State of Charge for navigating around DC fast chargers and seamlessly play Spotify, you probably wouldn’t want to fork over another $12 per month just for your car to connect back to the mothership.

Speaking of which, data privacy is also one of the survey respondents’ biggest concerns:

Data privacy has been the biggest industry concern as automakers seek recurring revenue and monetization opportunities. Consumers are wary of how their driving data (location, habits, etc.) is being collected, stored, and used, especially given the potential for misuse or unauthorized access. Lack of transparency in data policies has been proven to reduce consumer trust, especially among privacy-conscious users.

Additionally, connected car security concerns have been difficult to overcome. Connected cars are vulnerable to hacking, data breaches, and malicious attacks, raising more concerns about the safety and security of personal information and vehicle control systems. Evolving data privacy laws and regulations, such as those in Europe and North America, require automakers to prioritize data transparency and implement robust security measures for vehicle data.

Gone is the old adage of “if it’s free, you’re the product,” because not only are you paying, but you’re still the product. In case you forgot, GM was recently dragged over the coals when it was accused of doing exactly this and then selling driving habits to insurance brokers.

Currently, the U.S. has the highest number of survey respondents (35%) who subscribe to a connected service and pay out of their own pocket. This is followed by India at 33%, followed by China at 32%, South Korea at 30% and finally the United Kingdom at 29%. China and India have the most drivers who utilize free trials.

France has the most consumers who have rejected connected services, with more than half of all respondents. This is followed by the UK and Brazil, then closely by Germany. The U.S. places right around the middle at 38%.

Automakers think that they can outlast subscription fatigue. The biggest problem identified in the survey is that subscription models from automakers are still in the infancy phase, so it’s not clear exactly what consumers want to pay money for—and that’s one of those many data points that cars are feeding home to the mothership via connected services. Remember when Tesla removed lumbar support because their logs showed that there was “almost no usage?”

“We’re trying to figure out what consumers are willing to pay for, how much they’re willing to, (and) how they want it bundled,” said Stephanie Brinley, S&P’s associate director of auto intelligence.

This means that automakers are going to continue to roll out new features and tech to see what consumers find intriguing and useful enough to pay for. Keep in mind that if the hardware is already installed in the car and worked into the cost (think: heated seats or extra performance), the margin on a software-enabled feature is extremely high.

Margins and revenue, that’s what this is all about. If automakers can find a new way to squeeze a few extra dollars out of their products—especially at scale—it’s a way to drastically improve margin on their products while also cutting out the revenue paid to third parties like dealerships. Plus, the revenue from selling customer data opens up yet another revenue stream not possible 10 years ago.

But on the consumer side, this isn’t a good experience. Nobody wants to pay extra for something already in their car. That line also gets middier when comparing a cheap, all-encompassing feature versus the value proposition of making driving safer or more convenient. For example, swallowing $9.99 per month for connected services is a lot easier than ponying up $99 for automated driving assistance.

Automakers are remaining pretty flexible for now. It’s all about collecting data and testing the waters. If consumers revolt or aren’t willing to pay, maybe it’s not worth investing in a particular feature or even embedding the hardware in a car. But if something is a hit, it could be a treasure trove with very little overhead capital required to maintain it. And that’s where automakers are looking to strike gold.

Source link